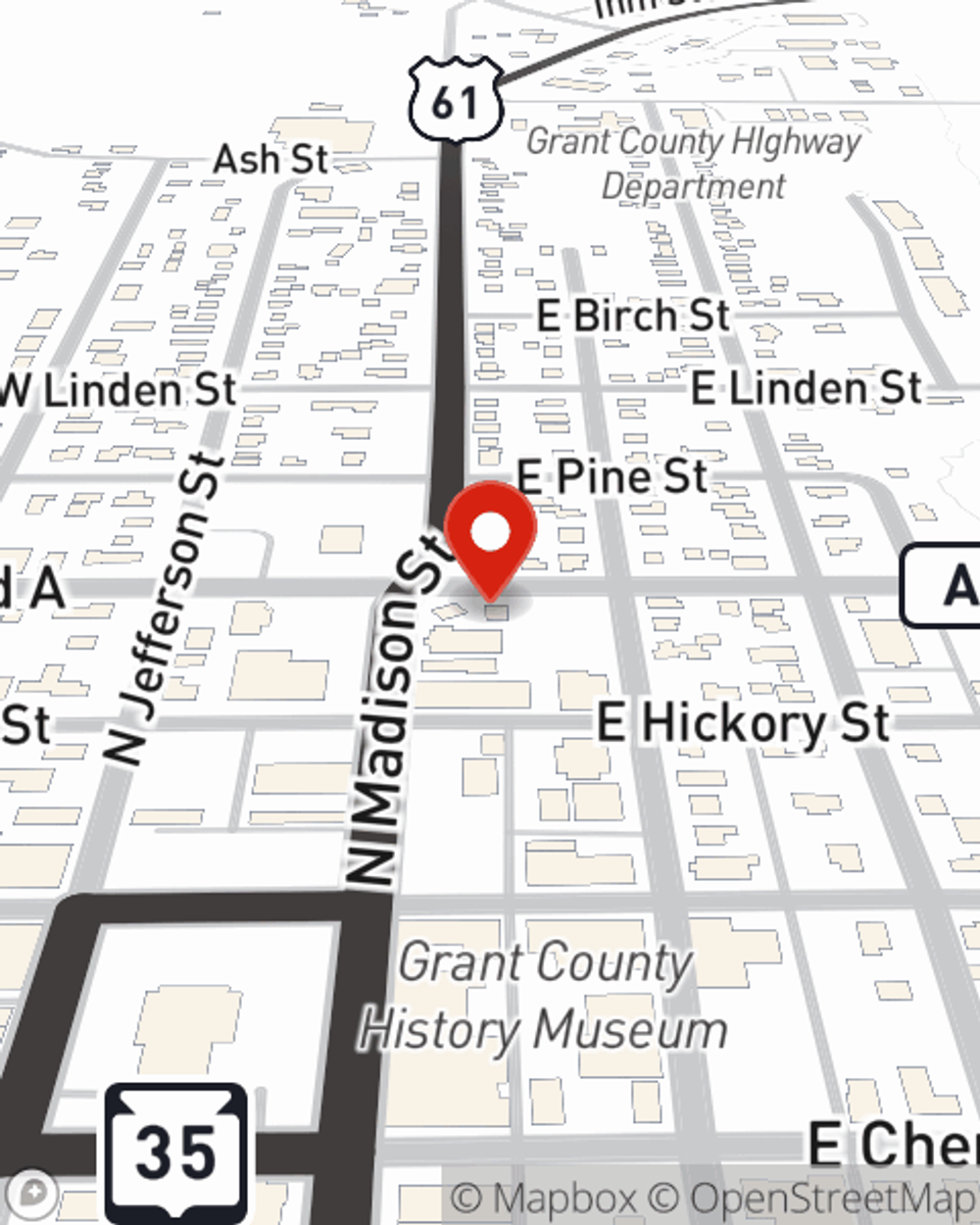

Business Insurance in and around Lancaster

Calling all small business owners of Lancaster!

Helping insure small businesses since 1935

- Lancaster

- Fennimore

- Cassville

- Platteville

- Livingston

- Montfort

- Potosi

- Rewey

- Glen Haven

- Beetown

- Bloomington

- Cobb

- Woodman

- Mount Hope

- Dickeyville

- Hazel Green

- Bagley

- Linden

- Cuba City

Coverage With State Farm Can Help Your Small Business.

Do you own a home cleaning service, a pet groomer or a fabric store? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on your next steps.

Calling all small business owners of Lancaster!

Helping insure small businesses since 1935

Protect Your Future With State Farm

When one is as driven about their small business as you are, it makes sense to want to make sure everything is in order. That's why State Farm has coverage options for worker’s compensation, artisan and service contractors, commercial liability umbrella policies, and more.

As a small business owner as well, agent Jaclyn Bevan understands that there is a lot on your plate. Get in touch with Jaclyn Bevan today to discover your options.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Jaclyn Bevan

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.